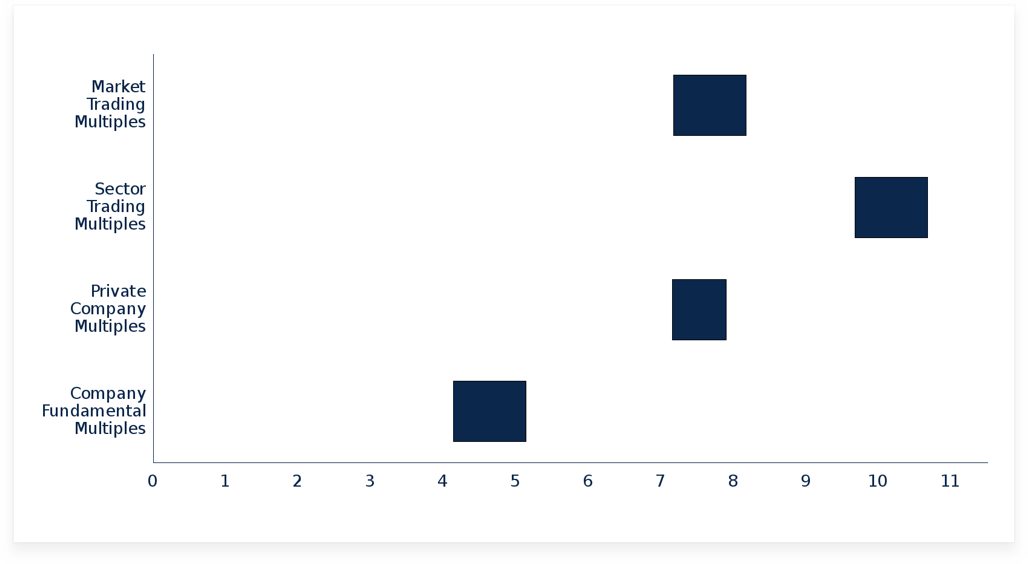

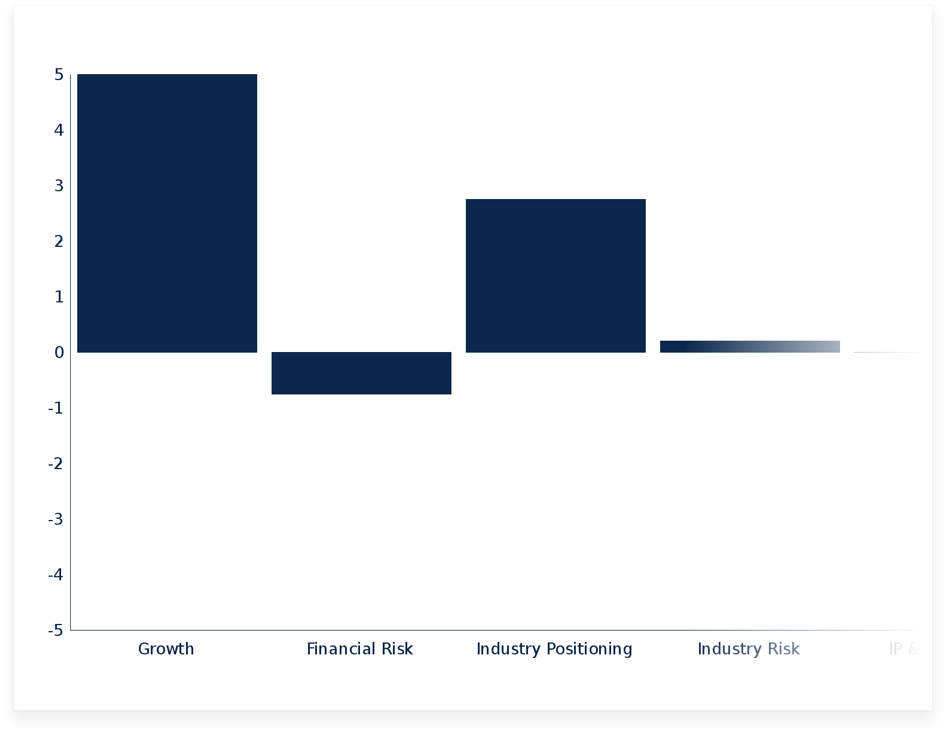

You will be providing the data that the valuation is based upon and that which forms the principle elements making up the valuation. InterFinancial will establish an overall Earnings multiple range for the market for all listed industrial companies in Australia. These will then be adjusted with the help of your answers to the questionnaire to develop a range for your firm/business.

Given the nature of the delivery of the indicative valuation InterFinancial will not have become aware of all information that may be relevant to a valuation. Furthermore, we will not have corroborated the information received. Should a detailed valuation be conducted the valuation conclusions could materially differ to those reached in an indicative valuation report.